“We fishermen are the ones who earn the least”

Últimas noticias

AZTI wins the 24th JACUMAR Award with a pioneering PCR method to determine the sex of sturgeons

JUVENA 2025: The abundance of juvenile anchovies in the Bay of Biscay has doubled the historical average

Ethics in Artificial Intelligence for Food and Health: From “Can Do” To “Should Do”

RAÚL PRELLEZO & MARGA ANDRÉS (Sustainable Fisheries Management)

ANA BARANDA & SOFÍA ROCA (New Foods)

JAIME PÉREZ (AZTI Data Ecosystem)

MARINA SANTURTÚN (Sustainable Fisheries and Oceans Market Director)

Hake is a staple food in Basque households. In 2024, people in Euskadi consumed 4,070 tonnes of fresh hake, worth a total of 46 million euros. However, this is the lowest consumption level recorded since 1999. According to AZTI’s Household Consumption Data Observatory, consumption peaked at 10,500 tonnes in 2009 and has been steadily declining ever since, reaching today’s record low.

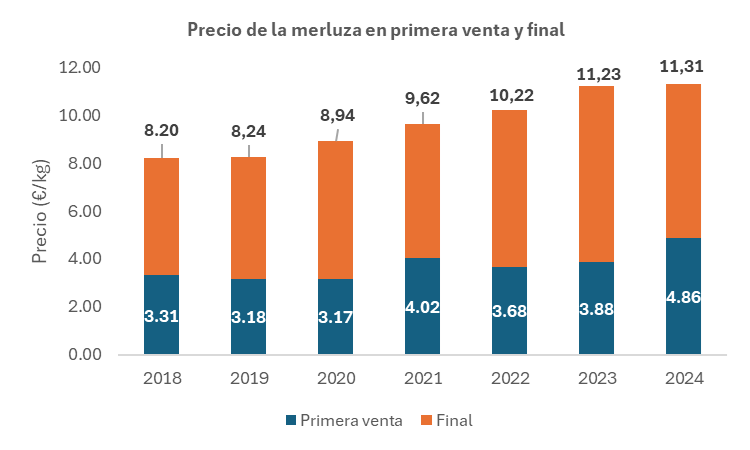

Consumer prices in the Basque Country have shown an almost constant upward trend, rising from €6.7/kg in 1999 to €11.3/kg in 2024. In contrast, the prices received by our arrantzales (fishers) have not followed such a consistent pattern. Between 2018 and 2024, their average hake landings were 3,550 tonnes. Yet in 2023, although catches were 40% lower than in 2018, first-sale prices increased by only 17%.

Without taking into account the margins applied by retailers and wholesalers within a complex value chain, it is worth examining whether the statement “fishermen are the ones who earn the least” is accurate, and under which circumstances. Preliminary evidence suggests that it is indeed true, as explained below:

Data show that the gap between the first-sale price and the retail price does not follow a simple, linear pattern. Instead, it fluctuates, with peaks and dips throughout the 1998–2024 period. Even so, there is a slight upward trend overall. Specifically, between 2018 and 2024, Basque consumers paid, on average, 2.61 times more for hake than the amount received by arrantzales at first sale.

This price gap is mainly driven by the first-sale price itself: the lower the origin price, the larger the difference; as first-sale prices rise, the gap narrows. Additionally, consumption levels also influence this gap—when consumption drops, the disparity between prices tends to grow.

This suggests that there are high fixed costs in the commercialisation chain, requiring relatively stable absolute income. Until recently, this helped explain the fluctuations and trends observed in the price gap. However, this explanation may not hold in the future. In 2024, fresh hake consumption reached a historic low, while first-sale prices increased by 25%—and yet the price gap shrank, reducing operating margins for distributors. These patterns indicate that the main changes stem from evolving consumption trends in hake, and possibly in other fresh fish.

Therefore, while the claim “we fishermen are the ones who earn the least” is valid, it is also important to highlight that there is a limit to how much operating margins can shrink, and that this trend will impact both arrantzales and distributors. Understanding the underlying causes is essential for designing better strategies to encourage hake and fresh fish consumption. In this regard, the consumer insights provided by AZTI’s Household Consumption Data Observatory—especially sociodemographic information—are key to supporting efforts to boost demand for a species so deeply rooted in Euskadi’s food culture.