Knowing recent data on the plant based market is important to understand its evolution and potential both in Europe and in Spain, and also to be able to anticipate its demand.

The plant based market in Europe

In Europe, plant-based foods represent a market worth 5.8 billion euros.

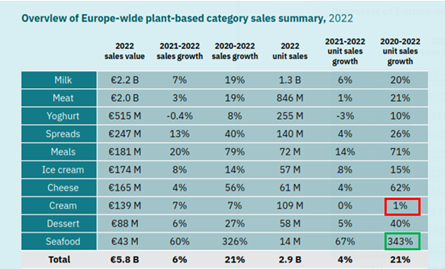

Retail sales data from Nielsen IQ[1] shows plant-based food sales growing by 6% in 2022 – and 21% since 2020 – to reach €5.8 billion (Good Food Institute, 2023). More interesting facts:

- 5.8 billion euros: this is the value of the plant-based food retail market in 2022, versus 4.8 billion euros in 2020

- + 6%: plant-based food sales growth between 2021 and 2022

- + 4%: plant-based food unit sales growth between 2021 and 2022

- 21%: growth in euro sales and unit sales of plant-based foods between 2020 and 2022

- Sales of plant-based meat grew by 21% in the EU (compared to a decrease of 8% for conventional meat)

The category’s sales performance in 2022 was influenced by the macroeconomic environment, characterised by the war in Ukraine, global trade tensions and inflation. Although there was a slowdown in retail market growth, both unit sales and sales in euro continued to grow, reflecting the strong consumer demand for these products.

In terms of categories, it is worth noting that milk substitute beverages are the biggest seller, followed by meats. However, the sector that is experiencing the biggest increase is seafood substitutes.

The case in Spain

Plant-based foods in Spain constitute a market worth 447.4 million euros. Here are some more interesting facts:

- The Spanish plant-based food retail market is the fourth largest market in Europe, and sales of plant-based foods continue to grow.

- Between 2020 and 2022, sales in euros grew by 9% to reach €447.4 million in 2022, behind only Germany (€1.911 billion), the UK (€1.077 billion) and Italy (€681 billion).

- To this €447.4m must be added sales of plant-based alternatives to yoghurts and desserts (omitted in GFI’s measurement) which, according to Alimarket’s estimates, would be in the range of €80-90m.

- Plant-based “milk”, which has experienced stable growth between 2020 and 2022, is the most developed category in Spain (sales of €352.8 million in 2022).

- Euro sales of plant-based meat decreased in 2022 (to 84.7 million euros), even though this category grew between 2020 and 2022 by 25 %.

- One of the least developed but fastest growing categories is seafood of plant origin (1.7 million euro sales in 2022).

Despite the current inflationary context, the plant-based offer continues to show positive numbers in our country and a growth of more than 30% in the number of registered launches.

Future projections

The European plant-based food market is expected to reach EUR 14,908 million by 2029, growing at a CAGR of 10.1% during the forecast period 2022 to 2029 (Business wire, 2022). Drivers for this segment include the rise in popularity of flexitarian and vegan diets, investments in plant-based product development companies and innovation in food technologies.

By 2035, assuming alternative proteins reach full parity in taste, texture and price with conventional animal proteins, it is projected that 11% of all meat, seafood, eggs and dairy consumed globally will be made from alternative proteins. With the push from regulators and technological changes, that figure could reach 22% (Blue Horizon & BCG. 2022).

—

[1] Nielsen IQ study in 13 European countries: Germany, UK, Italy, Spain, France, Netherlands, Sweden, Belgium, Poland, Denmark, Austria, Portugal and Romania.

[2] Good Food Institute Europe, based on Nielsen IQ data.