Alternative Proteins: Opportunity, Innovation and the Future of the Food Industry

Últimas noticias

The Ocean’s DNA: Unlocking a More Efficient Way to Monitor the Diet of Great Whales

[EATrends] Nourishing Wellbeing: Food and Health, Hand in Hand

OPTIPROT Network successfully concludes research on new sustainable and healthy protein sources, delivering high-impact results for the food industry

ANA BARANDA, ELENA SANTA CRUZ and SOFIA ROCA, experts in New Foods

The transition towards alternative protein sources is already a reality in the food industry, driven by consumers who are increasingly informed and concerned about health, sustainability and animal welfare. This paradigm shift is opening up new opportunities for innovation and market positioning across the sector. In this article, we explore the key factors that will help companies anticipate trends and respond to the new demands of the market.

Growing social concern about environmental and health impacts is transforming consumption habits. Choosing food products that are good for both personal health and the planet is becoming a clear priority. In this context, the inclusion of alternative protein sources to complement or replace traditional animal-based ones is emerging as an unstoppable trend.

The alternative protein market is expanding rapidly, with Spain now ranking as the fourth largest European market for plant-based foods and showing continuous sales growth. Projections suggest that by 2035, up to 11% of meat, seafood, eggs and dairy consumed worldwide could be made from alternative proteins — a figure that could double with further regulatory and technological support.

Índice de contenidos

Who are the potential consumers?

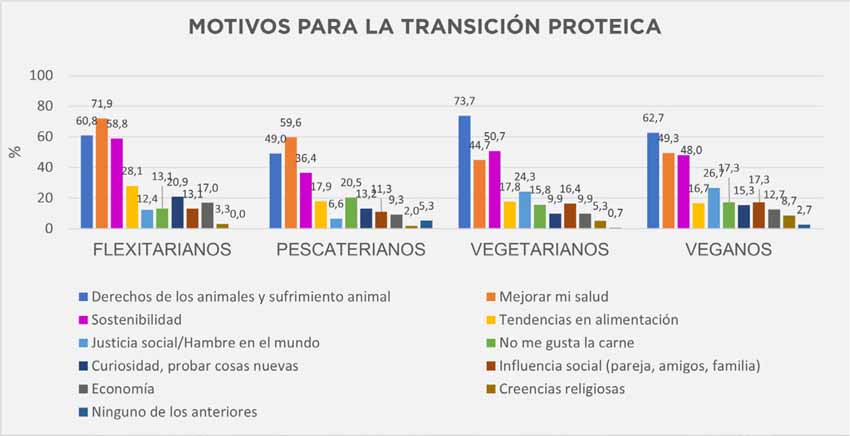

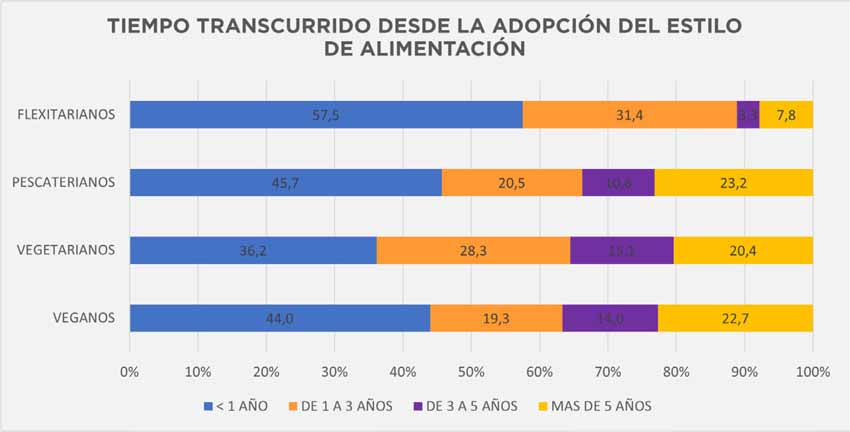

A nationwide study conducted by AZTI shows that the omnivorous diet remains the most common (62%), but 30% of the Spanish population now identify as flexitarian, while pescatarians, vegetarians and vegans together account for another 8%. The shift towards diets with less animal protein is particularly dynamic among flexitarians, with 90% of new adopters joining this group in the last three years.

Motivations vary: health, sustainability and animal welfare are the main drivers of change, with nuances depending on dietary group. The trend points to continued evolution — almost half of omnivores and the majority of flexitarians expect to further reduce their consumption of animal products in the future.

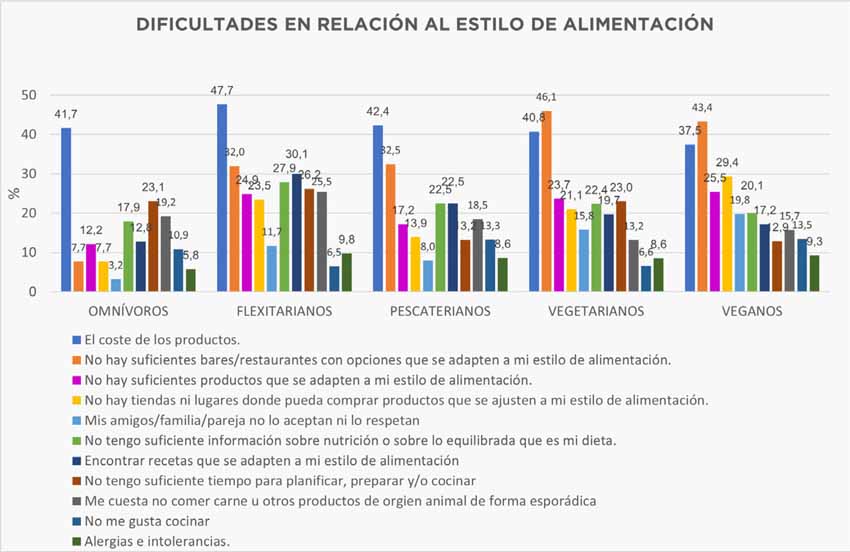

Barriers and consumption habits

Consumers identify the main obstacles as the cost of products, limited suitable options and the lack of specialised retail outlets — particularly for more restrictive diets. However, the convenience and accessibility of supermarkets encourage the purchase of plant-based products, with dairy alternatives being the most widely consumed across all groups.

Purchase frequency is typically weekly, or even several times a week, and information on ingredients, price and expiry date are the most decisive factors when choosing what to buy.

Types of alternative proteins

Innovation in alternative proteins spans a range of sources and technologies:

- Protein blends and hybrids: Combine animal and plant proteins to reduce saturated fats and improve nutritional profiles without sacrificing sensory experience.

- Plant proteins: Derived from legumes, cereals, nuts, seeds and algae, these stand out for their low saturated fat and cholesterol content, as well as their fibre and antioxidant benefits.

- Mycoproteins: Produced through fungal fermentation, they offer high protein content and a complete amino acid profile, with advantages in sustainability and production efficiency.

- Algae: Both macro- and microalgae provide high-quality proteins, vitamins and minerals, offering sustainability benefits and strong innovation potential.

- Insects: A source of high-quality protein, healthy fats and micronutrients with a very small environmental footprint. Cultural acceptance and regulation, however, remain challenges to overcome.

- Cultivated meat: Produced from animal cells, it allows the creation of real meat with a smaller environmental impact and without the need for animal slaughter. Commercialisation in Europe is still at an early stage.

Awareness, trust and willingness to try

Awareness and trust in different alternative protein sources vary across consumer profiles. Plant-based products and algae enjoy the highest levels of confidence and willingness to consume — exceeding 70% in all groups. Mycoproteins and hybrids attract interest, though awareness remains limited. Insects and lab-grown meat are well-known but less accepted, largely due to cultural and perceptual barriers.

Motivations and barriers

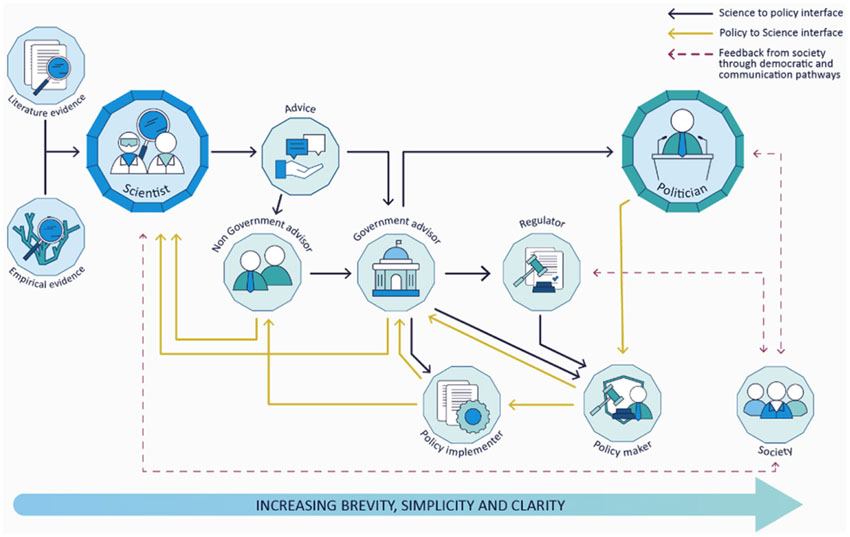

Price, ingredients and origin are key factors — both as motivators and as barriers. Consumers value health impact, sustainability and sensory similarity to traditional products. The presence of additives, high prices and lack of information can hinder adoption. Transparent communication and innovation in product formulation are essential to overcome these challenges.

Market expectations and opportunities

Demand for alternative products is particularly strong in the dairy, seafood and meat categories, with plant-based yoghurts and cheeses, as well as chicken, beef, tuna and salmon analogues, leading consumer preferences. Flexitarian consumers are emerging as a strategic, high-potential niche for the industry.

Conclusions and opportunities for the food industry

Alternative proteins represent a unique opportunity for the food industry:

- Innovation and differentiation: Developing new products and expanding the range in high-acceptance categories (plant-based, algae, hybrids).

- Communication and trust: Marketing strategies that highlight health and sustainability benefits while building confidence in lesser-known protein sources.

- Flexibility and adaptation: Anticipating evolving eating habits and aligning product offerings with the fastest-growing market segments.

The full AZTI report (available on request at consultas@azti.es) offers a detailed analysis, exclusive data and strategic recommendations for companies aiming to lead the protein transition and seize the full potential of this expanding market.

*This article was originally published in the November 2025 issue of Tecnifood.